tn franchise and excise tax mailing address

Internal Revenue Service PO. You can print other Tennessee tax forms here.

Tennessee Franchise Excise Tax Price Cpas

Box 1300 Charlotte NC 28201.

. 615 253-0700 1-800-342-1003 ln State Toll-Free E-mail. Generally hardship exceptions will include taxpayers who do not own a computer. Accounting Finance Tax Law Tax Intuit QuickBooks See more.

It is calculated from the due date of the estimated Install the signnow application on your ios device. 14 Provide the business telephone number fax number if any and email address in the space provided. 500 Deaderick Street Nashville TN 37242 Instructions.

All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax. Application for Extension of Time to File Franchise and Excise Tax Return You may file this extension along with your payment electronically at. All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the fiscal year.

Taxpayer Services 500 Deaderick Street Nashville Tennessee 37242 Phone. ET-2 - Federal Bonus Depreciation is not Deducted for Excise Tax. All franchise and excise returns and associated payments must be submitted electronically.

The excise tax is. Franchise tax is figured at25 of the net worth. Other Tennessee Corporate Income Tax Forms.

615 741-7071or 615 741-7074 LiensReleases Penalty Waivers. FEIN Due Date FOR OFFICE USE ONLY Taxpayers Signature Date Title Tax Preparers Signature Date Telephone Preparers Address City State ZIP Under penalties of perjury I declare that I have examined this report and to the best of my knowledge and belief it is true correct and complete. And you ARE NOT ENCLOSING A PAYMENT then use this address.

Online Filing - All franchise excise tax returns must be filed and paid electronically. Excise tax is based on 65 of net earnings from tn business profits. Internal Revenue Service PO.

Department of the Treasury Internal Revenue Service Kansas City MO 64999-0002. The articles below constitute published guidance as defined in Tenn. In addition describe the individual business entitys predominant business activity stating the major products andor services sold.

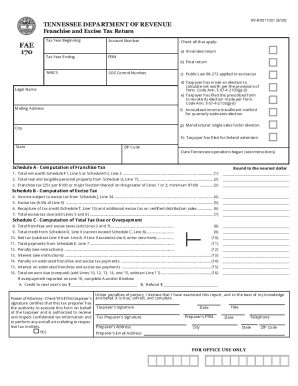

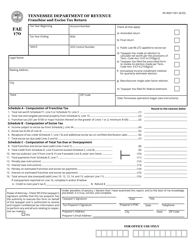

Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a Amended return b Final return c Public Law 86-272 applied to excise tax d Taxpayer has made an election to calculate net worth per the provisions of Tenn. ET-1 - Excise Tax Computation. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer.

Please view the topics below for more information. Tennessee Department of Revenue Attention. Bankruptcy Liens and Releases.

Please visit the File and Pay section of our website for more information on this process. This will be the person who the Tennessee Department of. FT-1 - Franchise Tax Computation.

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. Mp3 files need help transcribing need help adding google adsense site freelance need help wsdl file open source projects need help need help text website need help building resume need help fixing cre loaded coldfusion website need help need help. If you have questions about Franchise And Excise Tax Online contact.

Tennessee Department of Revenue. Please view the topics below for more information. If the entity is a single.

Andrew Jackson State Office Building 500 Deaderick Street Nashville TN 37242. If you are a corporation limited partnership limited liability company or business trust chartered qualified or registered in Tennessee or doing business in this state then you must register for and pay franchise and excise taxes. Need help with Filing TN Franchise and Excise Tax.

Franchise Excise Tax Return Mailing Address Tennessee Department of Revenue Andrew Jackson State Office Building 500 Deaderick St. Mailing address location address Secretary of S tate number business phone number business fax number and e- mail address Federal Employer Identification Number and franchise and excise account number. Box or mailing facility address is acceptable.

Return Mailing Address without Refund. 15 Provide the contact information for the business. Nashville TN 37242 Account No.

The excerpts from the tennessee code are through the 2020 legislative session. Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a Amended return b Final return c Public Law 86-272 applied to excise tax d Taxpayer has made an election to calculate net worth per the provisions of Tenn. The Department of Revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those laws.

You can download or print current or past-year PDFs of Form FAE-170 directly from TaxFormFinder. In the Type drop list select FR - State Franchise Tax FR - State Franchise Tax in Drake15 and prior the type FE - TN - FRANCHISE EXCISE TAX will provide the same result. Tn state tax you will file a tn annual franchise and excise tax return.

We last updated the Franchise and Excise Tax Return Kit in February 2022 so this is the latest version of Form FAE-170 fully updated for tax year 2021. Provide the business mailing address in the space provided. Nashville area and out-of-state.

Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State ZIP Code a Amended return b Final return c Public Law 86-272 applied to excise tax d Taxpayer has made an election to calculate net worth per the provisions of Tenn. And you ARE ENCLOSING A PAYMENT then use this address. Electronic Filing and Payment.

If you had a franchise excise tax account number before May 28 2018 the only change to this number is the addition a zero to the beginning of the number. Box 1214 Charlotte NC 28201-1214. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee.

123456789 New account format. The payments appear on TN FAE 170 PG 2 in View in Drake15 and prior the page is TNFAE170PG2.

Fae 170 Fill Out And Sign Printable Pdf Template Signnow

Franchise Excise Tax Obligated Member Entities Youtube

2017 2022 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank Pdffiller

Get And Sign Tennessee Department Of Revenue Franchise And Excise Tax 2021 2022 Form

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms

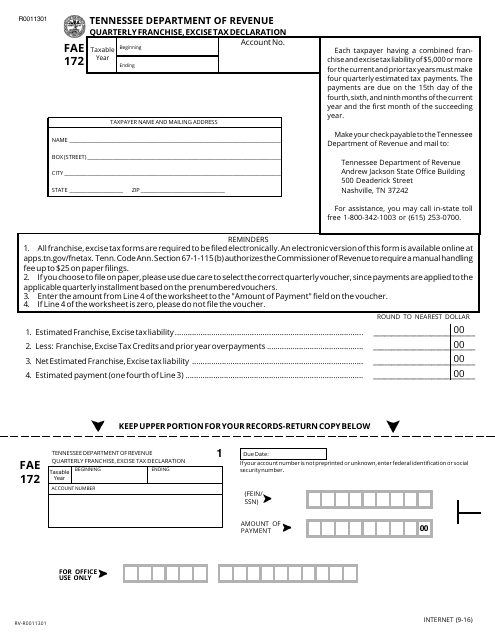

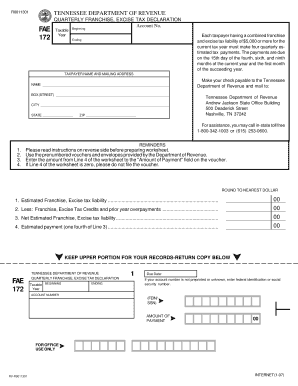

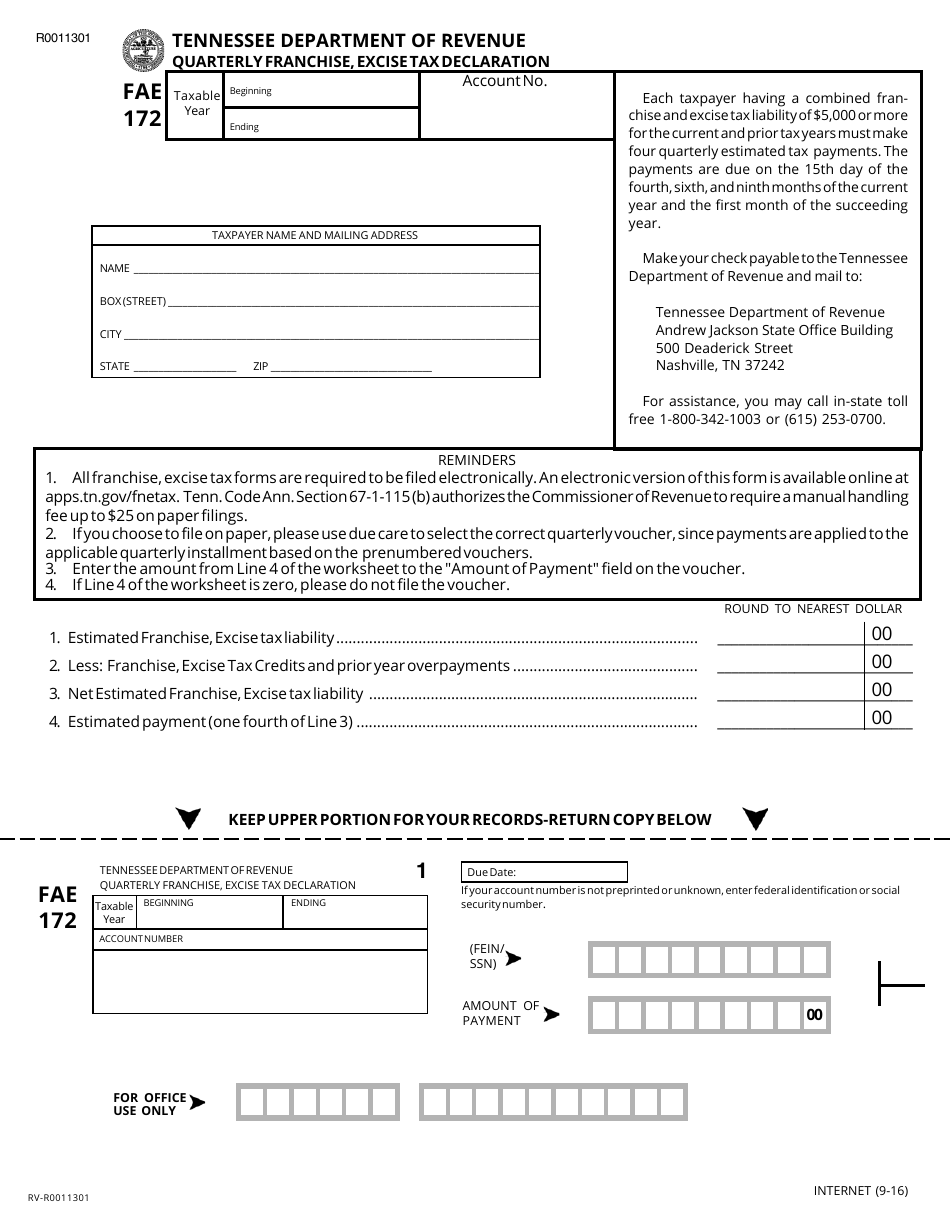

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Tn Franchise Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

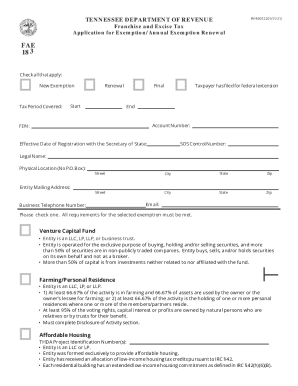

Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print Pdffiller

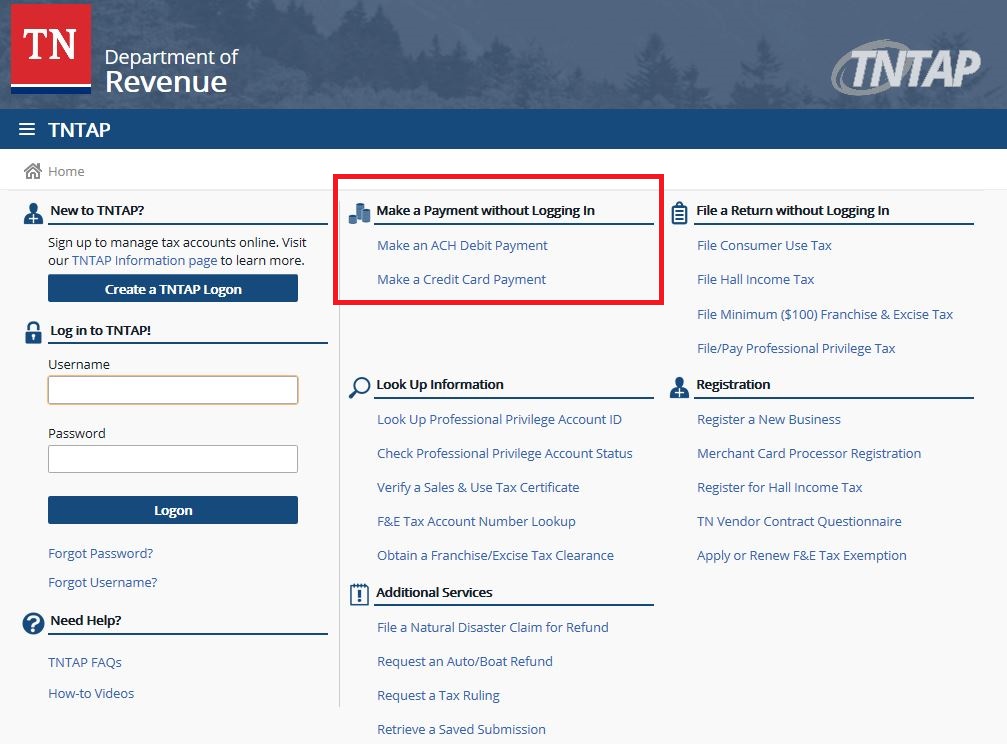

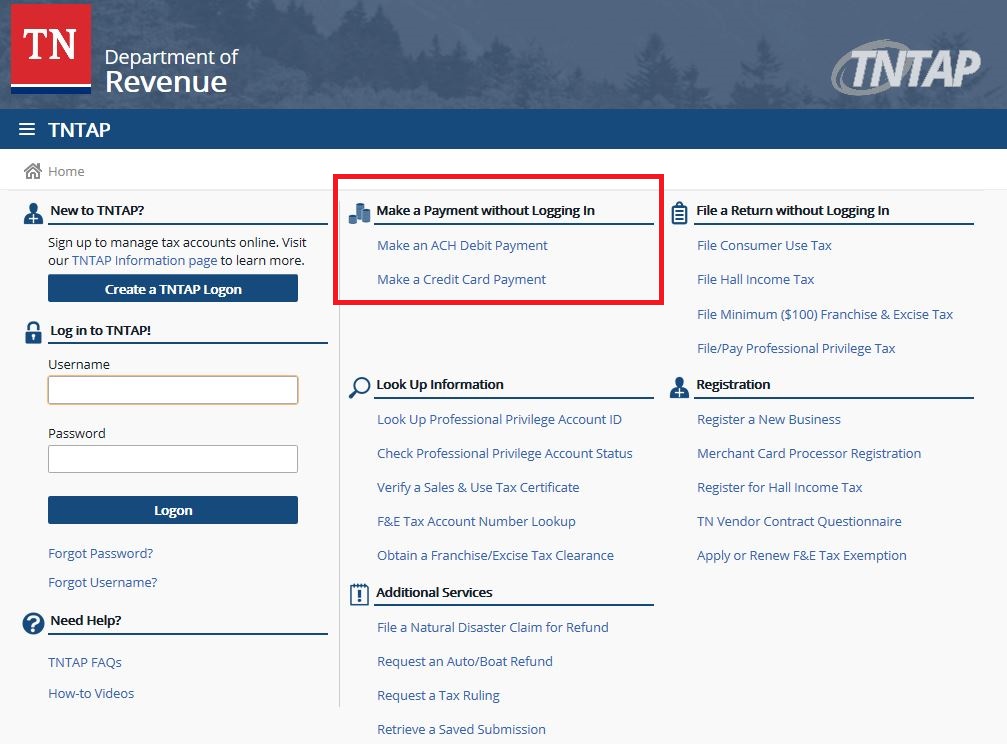

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

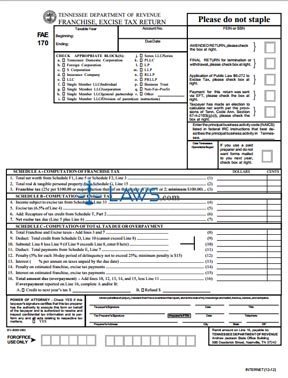

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

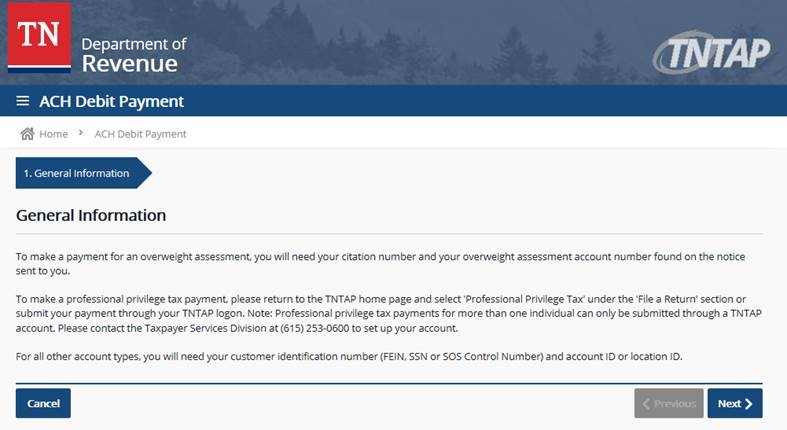

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

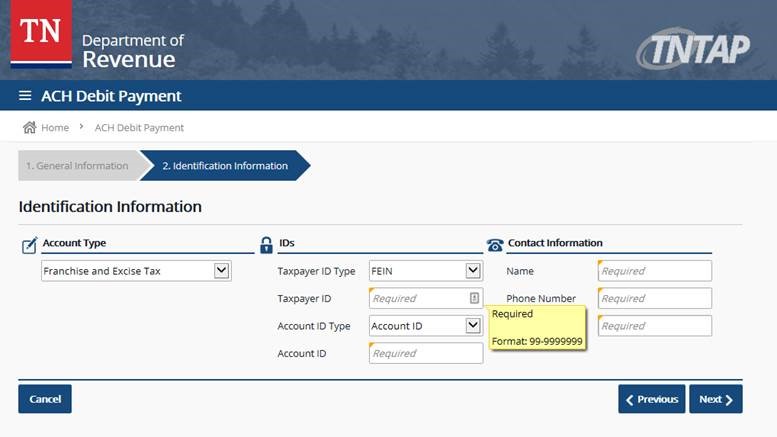

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tn Fae 172 Fill Out And Sign Printable Pdf Template Signnow

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Form Fae 170 Franchise And Excise Tax Return Kit

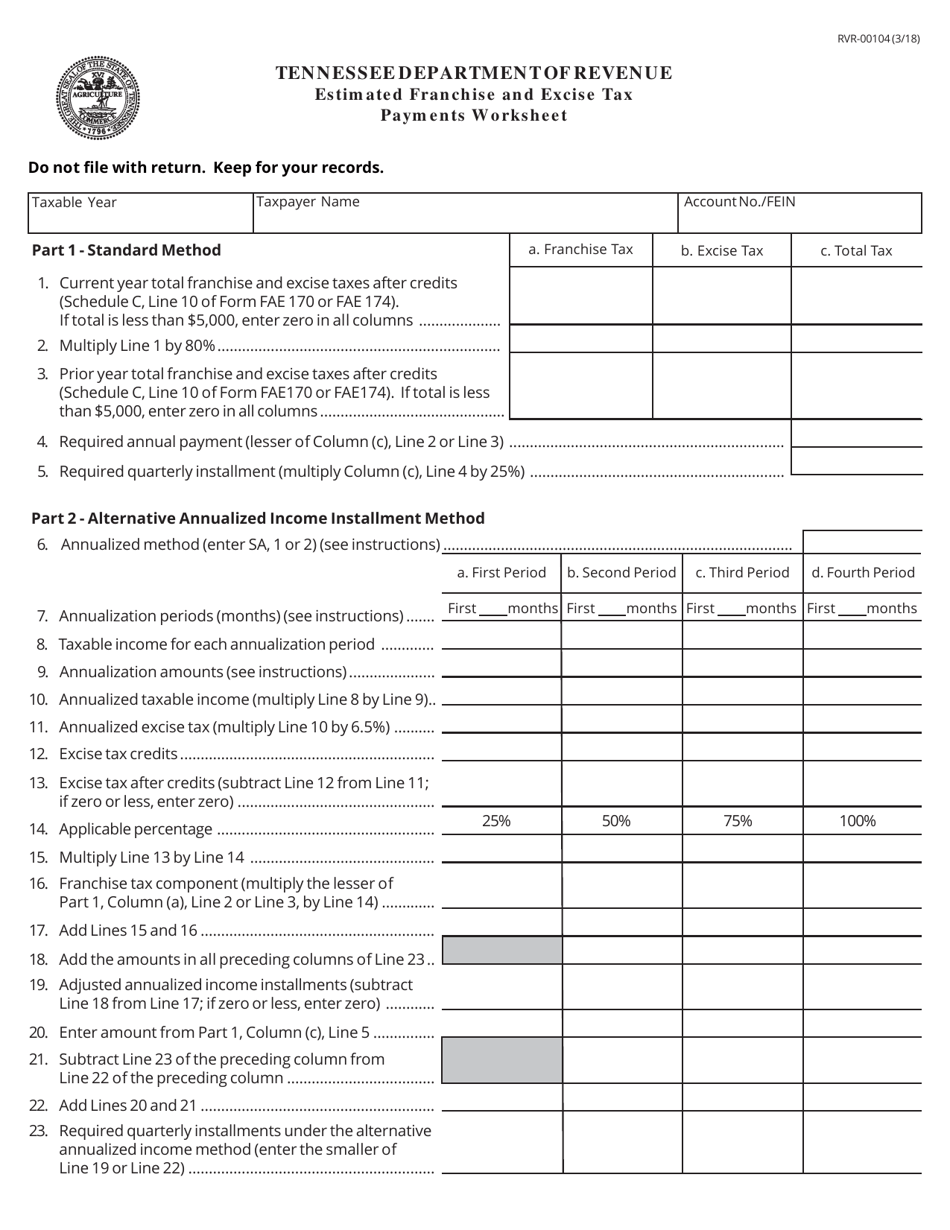

Form Rvr 00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller