tax avoidance vs tax evasion australia

A poll tax also called a per capita tax or capitation tax is a tax that levies a set amount per individual. We can provide you with a reduced rate assessment for your first call to our offices at 800 681-1295.

Tax Evasion The Budget Cost Prosper Australia

If you know or suspect that you are the target of an IRS criminal tax investigation contact the dual licensed Criminal Tax Defense Attorneys CPAs at the Tax Law Offices of David W.

. Withholding tax is chargeable for the following types of payments. 139 Future directions for reform of tobacco taxes. 301116 was a form of the poll tax.

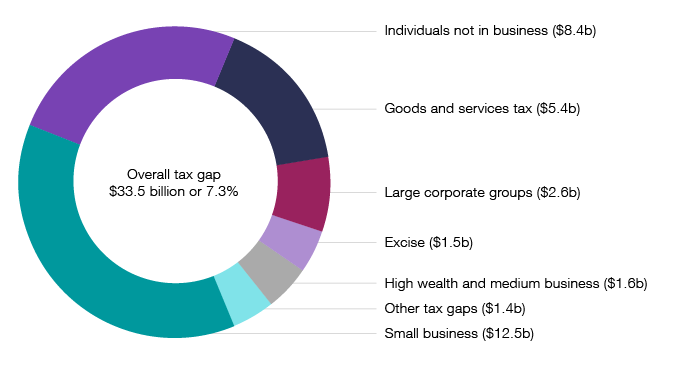

138 What is the right level of tobacco taxation. Report tax evasion. Tax and individuals - not in business.

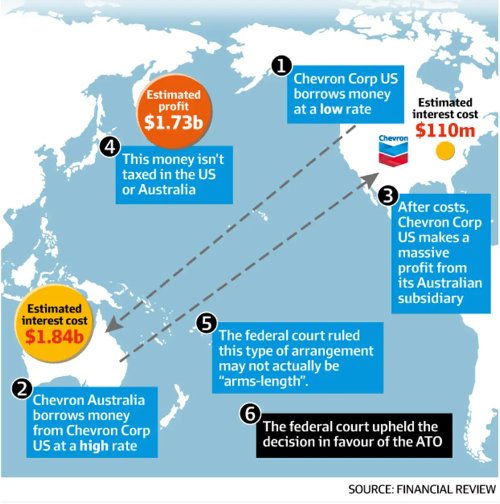

BEPS hubs or Conduit OFCs strongly deny they are corporate tax havens and that their use of IP is as a tax avoidance tool. They call themselves knowledge economies. When a person pays interest or fees in connection with a loan such as interest on late payments a withholding tax of 15 is chargeable on the payment.

137 Avoidance and evasion of taxes on tobacco products. What are the Types of Payments Subject to Withholding Tax and their Tax Rate. Tax evasion can include federal and state employment taxes state income taxes and state sales taxes as well.

1310 Arguments against tax increases promoted by the tobacco industry. In addition he either filed false federal income tax returns or failed to file federal income tax returns for the years. The headline rate is not what triggers tax evasion and aggressive tax planning.

We would like to show you a description here but the site wont allow us. Generally this includes fuel on which duty is payable under customs and excise law and also includes compressed natural gas liquefied petroleum gas or liquefied natural gas. It is an example of the concept of fixed tax.

The following example illustrates this. Keep in mind that tax evasion isnt limited to federal income tax. B for the avoidance of double taxation of income under this Act and under the corresponding law in force in that country or specified territory as the case may be 47 without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance including through treaty-shopping arrangements aimed at obtaining reliefs.

Poll taxes are administratively cheap because. Tax and Corporate Australia. 1311 Are tobacco taxes regressive.

Tax and Corporate Australia. One of the earliest taxes mentioned in the Bible of a half-shekel per annum from each adult Jew Ex. Fix a mistake or amend a return.

That comes from schemes that facilitate profit shifting. 136 Revenue from tobacco taxes in Australia. Tax and small business.

Dispute or object to an ATO decision. Retail fuel means taxable fuel within the meaning of the Fuel Tax Act 2006 that is sold by retail. The fight against tax crime.

Tax Evasion Statistics 2022 Update Balancing Everything

Tax Evasion In The Oil And Gas Industry National Whistleblower Center

Explainer The Difference Between Tax Avoidance And Evasion

Tax Avoidance What Are The Rules Bbc News

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Avoidance Vs Tax Evasion Muslim Perspectives On The Ethics Of Tax Amust

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Tax Evasion Statistics 2022 Update Balancing Everything

Why It S Time To Talk About Corporate Tax Schroders Global Schroders

Differences Between Tax Evasion Tax Avoidance And Tax Planning

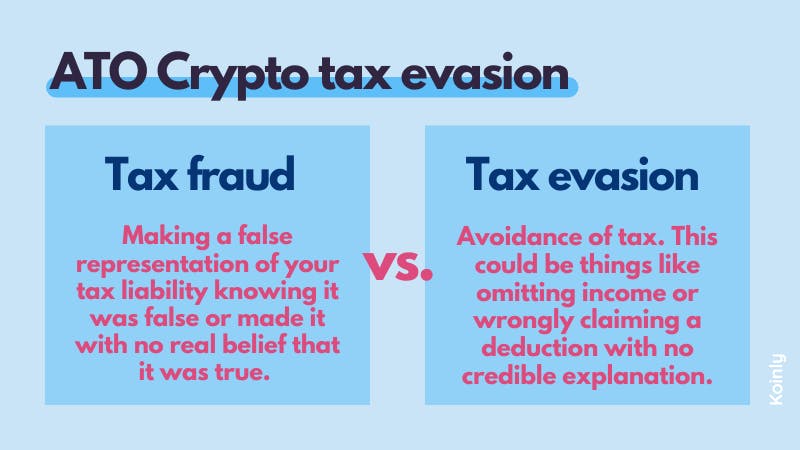

Ato Crypto Tax Evasion Risks And Penalties Koinly

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Explainer The Difference Between Tax Avoidance And Evasion